January 2025

While FPIs were net sellers of Indian equities in the secondary market amid rich valuations, sluggish demand and slowing GDP growth, FPIs pumped in a record INR 1.22 lakh crore ($14.5billion) into the primary market (IPOs). This has more than offset their exit from the secondary market to the tune of INR 1.21 lakh crore ($14.37 billion), resulting in a net inflow of INR 426.9 crore ($124 million) for the CY 2024.

A record 90 companies raised over INR 1.6lakh crore through IPOs during 2024.

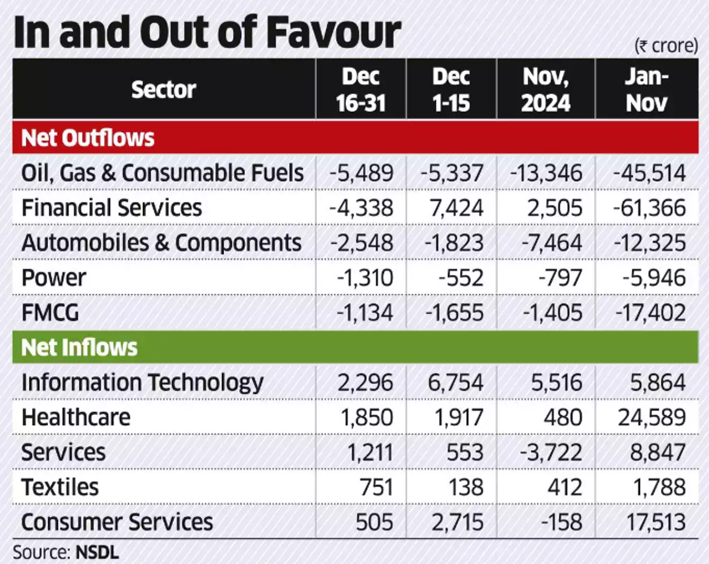

FPIs sold Indian equities worth INR 15,569 cr across 10 sectors between December 16 to 30. Overseas investors have traditionally had relatively large exposure to oil & gas stocks because of their prospects and liquidity but the uncertainty over oil prices is heightened due to escalation of the conflict in the Middle East.

Similarly, FPIs have major holdings in the financial services sector and their flows move in tandem with the market movements. If the market does well and is stable as it was in the first half of December, then they deploy funds in this sector and vice versa.

Automobile, Power and FMCG were the other sectors which saw selling pressure from FPIs. Sentiments towards auto sector may shift since auto stocks have been somewhat resilient but FMCG is expected not to correct a lot going forward even if markets correct as rural demand is likely to be supportive. FMCG may work out to be a defensive play for these investors.

IT sector which saw highest FPI inflows in Dec 2024 can become a hedge for these investors in a scenario where the USD is strengthening and the US economy is robust.

Trading activity in shares, equity derivatives slumped in Nov, weighed down by souring market sentiments and new measures introduced by SEBI. Turnover in options, most popular among retail investors, declined nearly 16%, futures turnover fell 8.3%.

Concerns over corporate earnings growth and rising US bond yields are keeping FPIs cautious. The low long-short ratio of FPI’s at 17.2% in the beginning of 2025 is a positive indicator indicating oversold conditions which opens up the possibility of a market rebound led by squaring up these bearish bets.

Corporate earnings have been lackluster for two consecutive quarters in FY 2025. FMCG companies’ profitability remained flat in Q3 due continued inflation in core commodities such as edible oil, wheat flour, coca and sugar. Edible oil prices in Q3 were 25% higher than prices in Q2. This has resulted in consumers downgrading their purchases and a reduction in stock at the trade level.

Urban stress is expected to persist for another two or three quarters. Urban demand is challenging due to inflationary pressure, low wage growth and higher housing rentals.

Volatility will remain elevated at the onset of Q3 earnings season, policy measures from the Trump government and Union Budget expectations.