February 2024

What the world wants to buy from India?

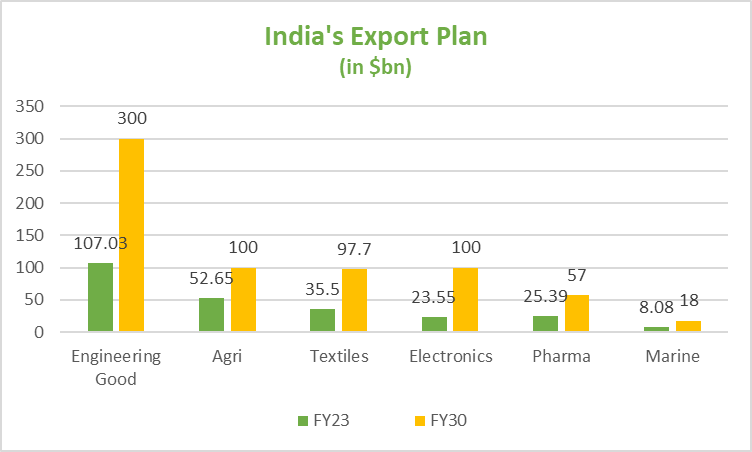

How can India achieve its lofty $1-trillion exports target by FY30? Which are the key sectors that will help India chase this target? To answer this, we need to look at the contribution of various sectors to current exports.

Out of the $451bn goods exported in FY23, engineering goods alone contributed to $107.03bn. This figure is likely to grow nearly 3-fold to $300bn by FY30. However, what on earth does engineering goods comprise of. Well, in the Indian context, exports in this sector are led by drones, turbo jets, solar panels, auto and auto components, EVs and their parts.

The other big category of exports that’s likely to quadruple is electronics items fueled by growth in mobile phone, laptops, wearable electronics and electronics accessories.

But what does exports have to do with how you build your wealth? That’s because your wealth creation process is directly linked to where and how you choose to invest your savings. So if you’ve decided to build wealth from your savings, then there’s no better option than investing in the Indian economy that is projected to grow at 7%. Ok, that sounds logical but what has that got to do with the export of drones or toys for that matter? Well, when we say our economy is slated to grow at 7%, what we mean is that our GDP is likely to grow at 7% and here’s the catch. Take a look at this equation for GDP.

GDP = C + (I+G)+ Net import

Or let’s put it this way,

GDP = C + (I+G) +(E-M)

Where, C = consumption

I = capital expenditure by private sector

G = capital expenditure by the Govt

E = exports

M = imports

Isn’t it now obvious, that the GDP of the 5th largest economy is also driven by its exports. So you see, how this export target of $100bn for FY30 that we’ve been talking about is going to contribute directly in increasing India’s GDP and drive your investment portfolio value in the next 6 years if you choose to invest in the right sectors.

A rising exports also has another positive impact on your portfolio, although an indirect one. Higher Indian exports means higher foreign demand for the Rupee and that’s obviously a positive for the Indian currency. A stronger currency also implies a more stable investment outlook. So doesn’t it now make sense to get down to the focus sectors for driving exports?

Let’s list down the six sectors that will drive our export engine to hit the $100b target by FY30. Engineering goods, electronics, marine and agricultural products, textiles and pharma have been identified as the key sectors that will help India meet its exports target.

If this wasn’t enough, all the online shopping that you’ve been doing is also going to get you some bonus points for your portfolio. That’s because, our ecom exports, driven by ayurvedic products, spices and handicrafts is likely to touch a whooping $200bn. So you see, how your online shopping cart has been boosting businesses in these segments that now they too will be able contribute in a big way not only to serve you but also customers from other countries in a big way. That’s quite some economic linkage to digest, isn’t it? Never mind, we are here to simplify things for you.

Now that we’ve the sectors to invest in, how do we identify the right investment opportunities within these sectors and buy them when they are slightly undervalued or reasonably priced to maximise our portfolio return?

That’s where the Investment Sprouts team can help you pick the right investment for your portfolio after assessing your risk profile.

Invest in the sectors that will help India chase this target.

Want a free assessment of your risk profile?